Global EOR

Global employer of record (EOR) services

Compliantly hire and pay across borders.

No entity needed.

List of countries currently supported by Breedj

Breedj currently provides global employer of record services across 54 countries on the African continent. In a near future, Breedj is set to extend its reach beyond Africa, expanding our global EOR solutions to other continents. This extension will provide organizations the chance to establish a global footprint, while having Breedj’s dedicated expertise and support navigating them through each step of their international growth journey.

As highlighted by the World Economic Forum, Africa will be the only region witnessing population growth by the end of the century. We see vast potential and opportunity in these diverse nations, and our mission is to empower both businesses and talents to thrive in this promising market.

Southern Africa

Your trusted global EOR

We simplify compliance and global employment

With Breedj as your global employer of record partner, you can eliminate the need to establish in-country branches. We act as the employer of record for your international employees, reducing your operational complexity and cost.

Our platform has been designed ensures that your overseas operations adhere to local labor laws, employment regulations, and tax rules, mitigating risks and fostering a culture of compliance.

Employment contracts

We handle employment contracts for both global employees and contractors.

Guaranteed compliance

Breedj ensures full compliance with your workers' local labor laws.

Global payroll

Our platform ensures accurate and timely international salary payments.

Legal expertise

Leverage Breedj's extensive expertise to navigate diverse employment laws.

Tax & contributions

Breedj handles tax & mandatory contributions as required by local labor laws.

Multiple currencies

Your workers are paid in their local currency, directly to their bank account.

Choose a global EOR platform with a vision.

Become part of a collective effort to shape a more sustainable world and directly contribute to the United Nations Development Goals (SDGs).

Experience the ease of international employment with Breedj, your trusted global EOR provider. Our employer of record platform has been designed to help you navigate the complexities of international hiring, ensuring compliance, and simplifying payroll management for your global workforce.

Global EOR: Turning challenges into opportunities

Managing an international workforce is a challenging task fraught with complexities. Navigating the labyrinth of different countries’ employment laws, understanding diverse cultural norms, managing international payroll and taxes, and ensuring global HR compliance can be an arduous and intricate process.

The risks associated with non-compliance to international employment laws can lead to hefty fines, reputational damage, and even business closure. These challenges often deter businesses from pursuing their global expansion ambitions, despite the potential for substantial growth.

Furthermore, setting up entities in each country of operation, an alternative approach to global expansion, can be a time-consuming and costly venture. It involves deep understanding of local legal structures, which may require businesses to seek legal counsel, adding an additional layer of complexity and expense.

This is where Breedj steps in. We are committed to addressing these challenges, ensuring that your business can confidently and compliantly expand internationally. As your trusted partner, we handle the intricacies of global employment, enabling you to focus on your core business activities and reach your global growth potential.

Global EOR : Frequently asked questions (FAQs)

1. What is a Global Employer of Record (EOR)?

A Global Employer of Record (EOR) is a third-party company that acts as the legal employer for your international employees. This means the EOR handles all the administrative and legal responsibilities associated with employing staff abroad, such as payroll, taxes, benefits, and contracts. You, the client company, maintain managerial control over your employees’ day-to-day work and tasks.

2. What are the benefits of using a Global EOR service?

There are many advantages to using a Global EOR service, including:

- Reduced costs and complexity: Avoid the time and expense of setting up and managing local subsidiaries in each country you operate in.

- Faster market entry: Quickly and easily hire and onboard talent in new international markets without the delays associated with establishing a legal entity.

- Improved compliance: The EOR ensures you comply with all relevant local labor laws, tax regulations, and social security contributions, minimizing legal risks.

- Peace of mind: Focus on your core business activities and core competencies while the EOR handles the complexities of international employment.

- Access to a wider talent pool: Recruit top talent from around the world without geographical limitations.

3. What types of companies use global employer of record services?

Companies of all sizes can benefit from using a Global EOR service. However, it’s particularly advantageous for:

- Startups and small businesses: They can expand their global reach without the initial investment and complexities of setting up foreign entities.

- Companies with a remote workforce: Easily manage and comply with regulations for geographically dispersed employees.

- Businesses entering new markets: Simplify and expedite international expansion efforts.

- Organizations with limited HR resources: Gain access to expertise in international employment law and compliance.

4. Are there any drawbacks to using a Global EOR?

While EOR services offer significant benefits, there are a few potential drawbacks to consider:

- Loss of employer branding: Employees might be less familiar with your company since the EOR acts as the legal employer.

- Less control over certain HR processes: The EOR handles some HR functions, so you may have less direct control over these aspects.

- Cost considerations: EOR services typically have fees associated with them. However, these can often be offset by the cost savings from not setting up foreign entities.

5. How does a Global EOR ensure compliance with local labor laws?

Global EOR providers stay up-to-date on complex and constantly evolving international employment regulations. They leverage their expertise and established presence in various countries to ensure your international workforce adheres to local labor laws. Here’s how they achieve compliance:

- Understanding local regulations: The EOR has a deep understanding of employment laws, tax regulations, and social security requirements in each country they operate in.

- Contractual agreements: They establish clear contractual agreements outlining employee rights and responsibilities, adhering to local legal frameworks.

- Payroll and tax management: The EOR accurately calculates and withholds taxes and social security contributions as mandated by local regulations.

- Ongoing monitoring: They stay informed about changes in employment laws and implement necessary adjustments to maintain compliance.

6. What are the risks of non-compliance with international employment laws?

Failing to comply with international employment laws can lead to severe consequences, including:

- Financial penalties: Significant fines and back taxes can be imposed by local authorities.

- Legal issues: Lawsuits from employees or government entities can be costly and time-consuming.

- Reputational damage: Negative publicity and a damaged employer brand can harm your ability to attract and retain talent.

- Operational disruptions: Non-compliance may lead to work stoppages or permit revocations, impacting your business operations.

- Visa and work permit issues: Failure to comply can jeopardize your international employees’ work authorization.

7. Who is liable for legal issues when using a Global EOR?

The extent of legal liability in an EOR arrangement can vary depending on the specific contract and local regulations. However, generally:

- The EOR assumes legal responsibility for administrative tasks: The EOR is responsible for ensuring compliance with payroll taxes, social security contributions, and employment contracts they manage.

- The client company retains liability for core employment practices: You remain responsible for managerial decisions, workplace safety, and employee relations.

It’s crucial to carefully review the EOR service agreement to understand the specific allocation of liabilities for various situations.

8. How does a Global EOR handle tax and social security contributions?

Global EOR providers manage tax and social security contributions for your international employees efficiently and accurately. Here’s what they typically do:

- Tax registration: The EOR registers your company for payroll taxes in each country where you have employees.

- Tax withholding and remittance: They withhold taxes from your employees’ salaries and remit them to the relevant tax authorities.

- Social security contributions: They calculate and pay social security contributions as required by local regulations.

- Tax reporting: The EOR handles tax reporting to ensure you meet all filing deadlines and requirements.

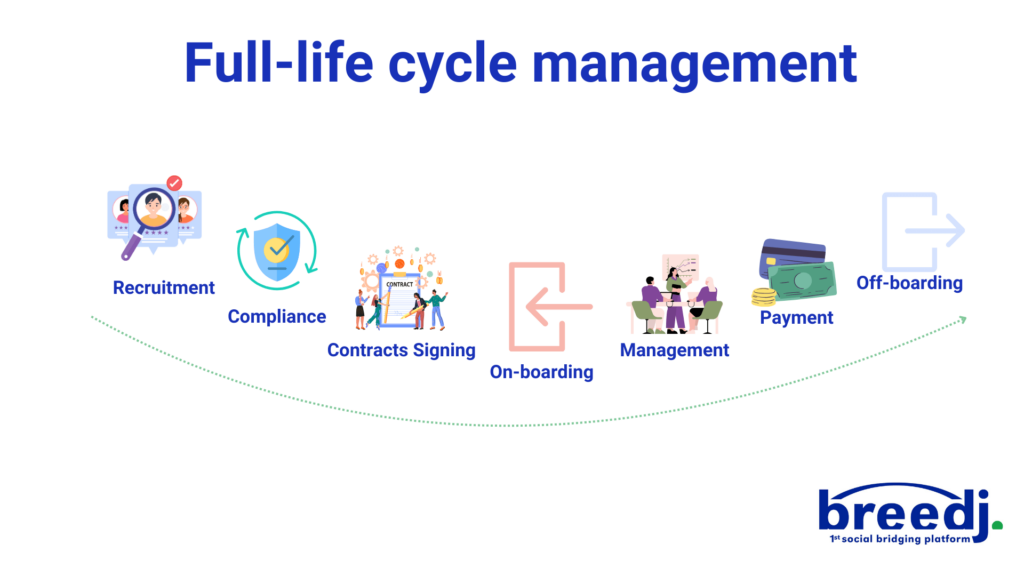

9. What services are typically included in a Global EOR solution?

The exact services offered by a Global EOR provider can vary depending on the company, but most comprehensive solutions will include:

- Employment contract management: The EOR drafts, negotiates, and manages employment contracts for your international employees, ensuring compliance with local regulations.

- Payroll processing: The EOR handles payroll processing for your international employees, including calculating salaries, withholding taxes and social security contributions, and making timely payments in the local currency directly to their bank accounts.

- Tax and social security compliance: The EOR ensures you comply with all relevant tax and social security requirements in each country where you have employees.

- Benefits administration: Some EOR providers may offer assistance with setting up and managing employee benefits plans, such as health insurance or retirement savings.

- Ongoing legal and compliance support: The EOR provides ongoing support to ensure your international employment practices remain compliant with evolving local laws and regulations.

10. Does a Global EOR offer support with employment contracts and terminations?

Yes, employment contract management is a core service offered by most Global EOR providers. They can draft compliant contracts, handle negotiations, and ensure proper termination procedures are followed according to local regulations. This helps minimize legal risks associated with international employment.

Breedj's platform

54 countries

Africa

Supports multiple currencies

Onboard remote workers in less than 24 hours

Testimonials

What they say about Breedj

Breedj streamlined our global hiring process, making it easy to find and pay remote talents. Our team loves how the platform handles payments and compliance.

Global expansion simplified

Confidently expand to global markets

Breedj stands out as the preferred global employment solutions provider for several reasons, offering organizations a competitive edge with a range of scalable global employment solutions.

Cost effective

Drastically reduce administrative and overhead costs related to managing global employees.

100% compliant

Stay up to date with the ever changing global legislations, policies and local labor laws.

Peace of mind

Get direct access to our global employment experts to mitigate legal risks and penalties.

Fast-track market entry

Bypass the complexities associated with establishing a branch office or in-country.

Help emerging countries

Encourage growth and uplift lesser served regions by giving a job to talented remote professionals.

Support United Nations development goals

Directly support at least four sustainable development goals, simply by using our platform.